by Amy Primeau | Sep 11, 2025 | Finance, Small Business

To ensure a successful future for your small business, planning ahead is essential. Building a financial planning & analysis (FP&A) process can help put your business on the right path. Terms to Know Your business’s FP&A process should include...

by Amy Primeau | Aug 18, 2025 | Finance

As your small business grows, it’s important to keep track of its revenue generation and the factors that may impact its profitability. Calculating your business’s Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) can help you figure out how...

by Amy Primeau | Aug 4, 2025 | Finance, Small Business

Starting and growing a small business takes vision, grit, and capital, but one unplanned incident can derail even the most promising venture. That’s why having the right commercial insurance policies in place isn’t just a box to check — it’s a critical part of...

by Amy Primeau | Apr 4, 2025 | Finance, Uncategorized

Small business owners have plenty of responsibilities to manage between daily operations, leading their teams, and keeping customers happy. If you choose to take out a business loan, autopay is a helpful option to make the repayment process simpler and more...

by Amy Primeau | Mar 25, 2024 | Finance

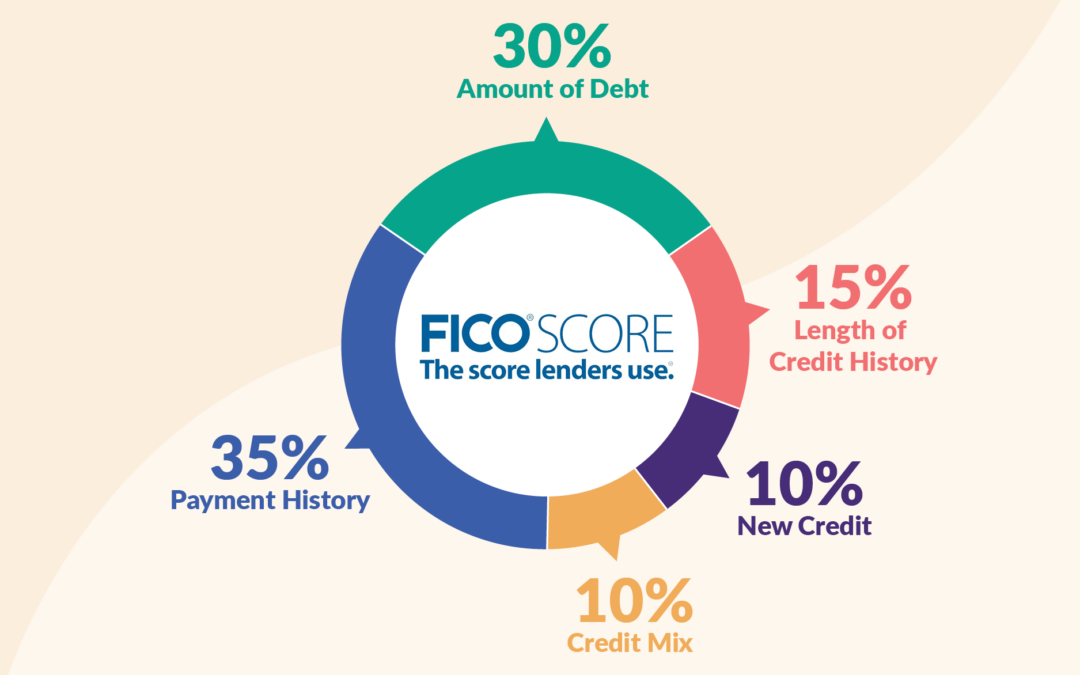

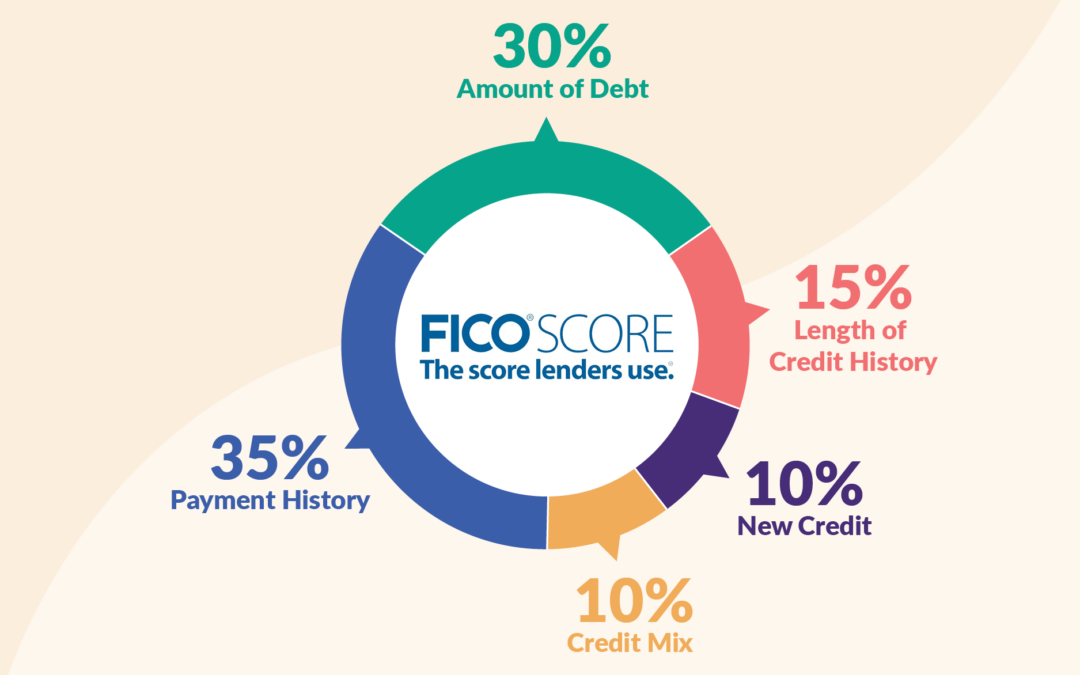

Your credit score is a crucial component in applying for small business funding. Lenders use your score to assess your responsibility as a borrower and, as a result, whether they should lend to your business. Maintaining a good credit score is key for setting...

by Amy Primeau | Nov 8, 2023 | Finance

Applying for funding is an exciting time for small businesses, but it’s no small decision to make. Small business owners must be committed to investing the time and effort that applications require. To make the process more manageable and boost the likelihood of...

Recent Comments