Preparing interim and year-end Profit & Loss (P&L) statements, also called income statements, should be business-as-usual for small business owners. In a single page document, a P&L gives a complete picture of your business’s financial health.

You can have a fantastic business plan and innovative model, but if you can’t show strong numbers, none of that matters.

Why are Profit & Loss Statements important?

An income statement is the front line, and bottom line, for showing the financial condition of your business. Small business lenders ask for P&L statements when deciding whether to take your business on with a small business loan or SBA loan, and the lender often asks for them throughout your repayment as well.

Investors also ask for Profit and Loss because, no matter how inspired they are by your business, they must see a demonstration of profitability.

For business owners and company managers, preparing and reviewing these statements, and noting changes, gives important insight into the business. Over time, financial statements show patterns and opportunities for improvement in simple black and white.

What information is shown on a Profit & Loss Statement?

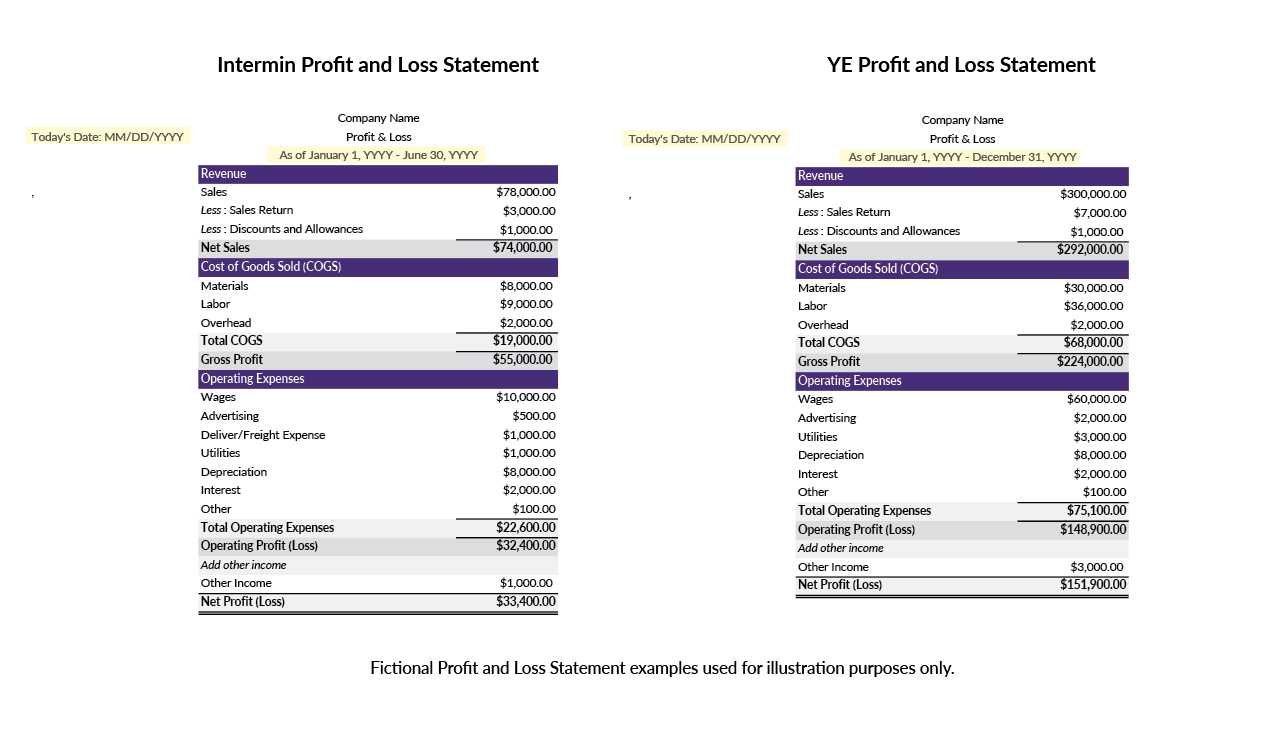

As the name suggests, a Profit & Loss statement gives a summary of the money that came into and went out of your business during a set period of time. It lists your revenue and the costs and expenses you incurred, broken down by category.

The revenue or “top line” is the fun part, outlining all the money the business made. The cost of goods sold, operating expenses, tax expenses, and interest expenses are itemized and subtracted from the revenue to show the profits, or “bottom line”.

Statement Timeframes

Year-end (YE) statement: Covers a whole fiscal or calendar year

Interim statement: Covers a shorter period of time, typically a quarter or six months

Common Mistakes to Avoid on Profit & Loss (P&L) Statements

- The wrong date in the wrong place. The dates on this statement are very important and are often not entered correctly when they’re not prepared by a finance professional. The statement has to show the time period the statement refers to, whether it’s year-end or interim, and it also must include the date when the statement was prepared.

- Not accounting correctly for paying yourself. The correct way to account for your own salary as the business owner depends on your business structure. Sometimes payments to yourself are not included on the P&L Statement, and sometimes they are. It’s important to consult an accountant to learn when and how to show your salary.

- Including “cost of goods sold” when your business doesn’t sell goods. If you’re a service provider, the line item for cost of goods sold should not appear in your expenses. Doing this in error can also lead to audits when tax season comes around.

- Inconsistent accounting – cash versus accrual. Accounting documents show your income and expenses either on a cash basis (money received/paid) or on an accrual basis (money invoiced/owed, but not necessarily paid yet). These documents include your tax returns! It’s important to make sure all your financial documents use one or the other consistently, and triple check your tax returns to make sure they match.

Preparing an income statement correctly avoids questions and revisions that can slow down the process when applying for a small business loan or purchasing commercial real estate. If you are not confident in your ability to prepare and update your P&L, consider hiring an accountant or CPA to put your business’s best foot forward.