A Step-By-Step Guide to Help You Apply

You do not have to complete the application in one session and will have an option to save and continue it later.

What items will you need at the time of applying?

You will need the following items readily available for use and upload at the time of applying:

- Most recently filed three years of business tax returns.

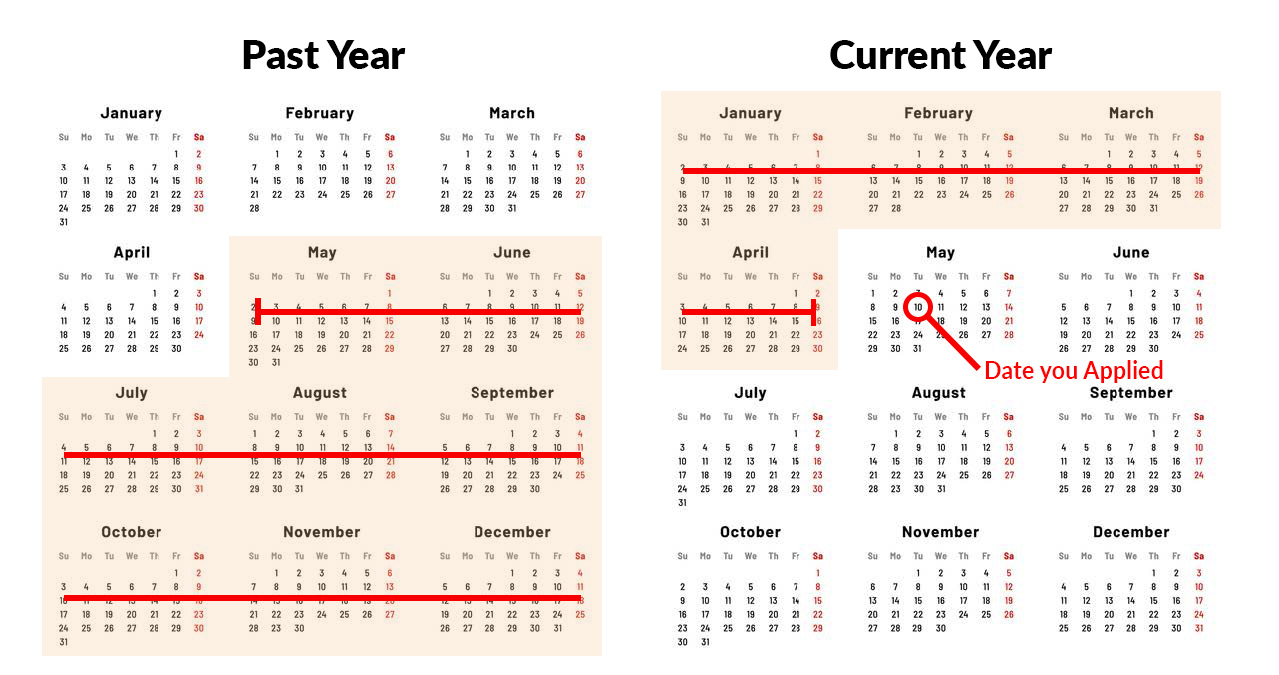

- Most recently filed personal tax returns for the past year.

- All business license(s) required by law for your state/industry.

- Business owner’s government-issued photo ID(s) – cannot be a photocopy.

- If your bank account is unable to be verified electronically, a copy of your last three months business bank account statements.

Hear from a real Lendistry customer about the application process.

Does applying affect your credit?

No, this application will NOT impact your credit score. For a smooth application process, make sure your credit report is NOT frozen.

A credit freeze restricts access to your credit report, which means you won’t be able to open a new credit account while the freeze is in place.

If your credit is currently frozen, you can temporarily lift the credit freeze by contacting each credit bureau listed below. Freezing and unfreezing your credit is FREE.

Experian: (888) 397-3742 | TransUnion: (888) 909-8872 | Equifax: (800) 685-1111

Technology Preparation

Use the Latest Versions of Website Browsers

For the best user experience, please use the latest version of Google Chrome, Microsoft Edge, or Safari throughout the entire application process.

Clear Your Cache

Cached data is information that has been stored from a previously used website or application and is primarily used to make the browsing process faster by auto-populating your information.

However, cached data may also include outdated information or information you may have previously entered incorrectly.

For instructions on how to clear your browser's cache, please click on the browser you're using for more details:

Chrome | Edge | Firefox | Safari

Signing Up for Your Lendistry Account

Registering your MyLendistry Account

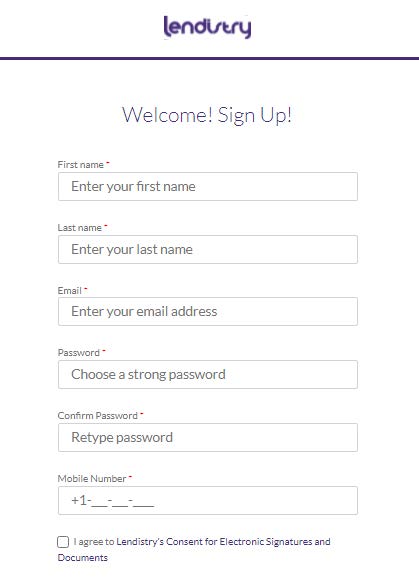

When registering your account, please do the following:

- Make sure you pick a strong password that includes:

- – 8 minimum character length

- – 1 uppercase character

- – 1 lowercase character

- – 1 digit

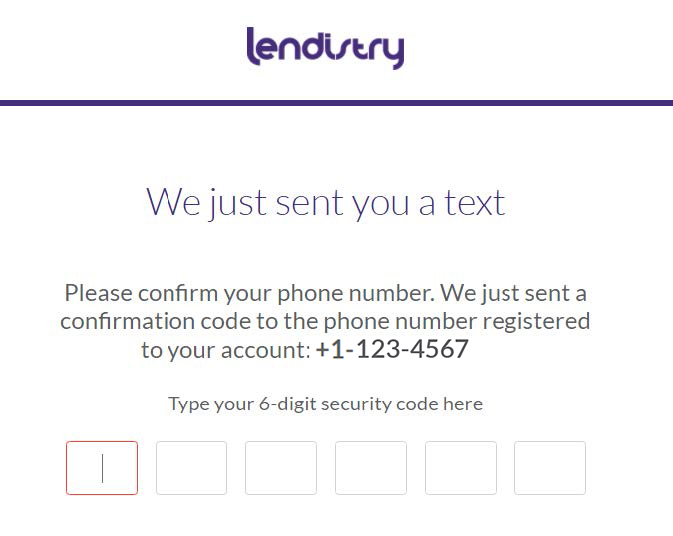

- You will be sent a confirmation code via text to be used during the registration process.

How to Unlock your MyLendistry Account

When attempting to log in to MyLendistry, if you use the incorrect password more than five times, your MyLendistry Account will be locked for your security.

Contact the Lendistry Customer Experience Center at 855-476-5870.

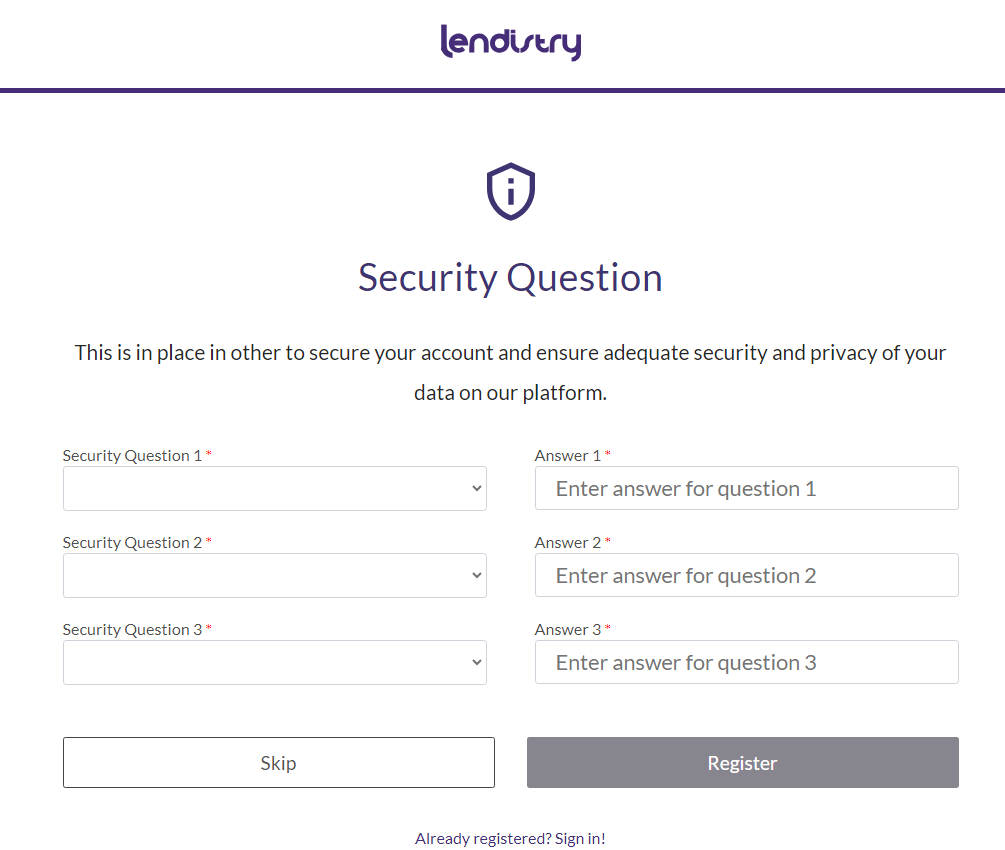

OR Answer your security questions correctly following these steps. This option will only be available if you answered these questions in your initial account set up.

Step 1

Provide your account information so that we can verify your identity.

Step 2

Confirm your phone number with the text you’ll receive.

Step 3

Answer the three security questions you selected correctly.

Step 4

Once the security questions have been answered correctly, a link to unlock your account will be sent to your email.

Step 5

Click on the link to unlock your account.

Step 6

After you unlock your account, you will have the option to sign in to Lendistry’s Portal using your existing password or to reset it. We strongly recommend you reset your password to prevent your account from getting locked again.

If your account has not been locked, you can reset your password by going to the MyLendistry sign-in page and following the instructions.

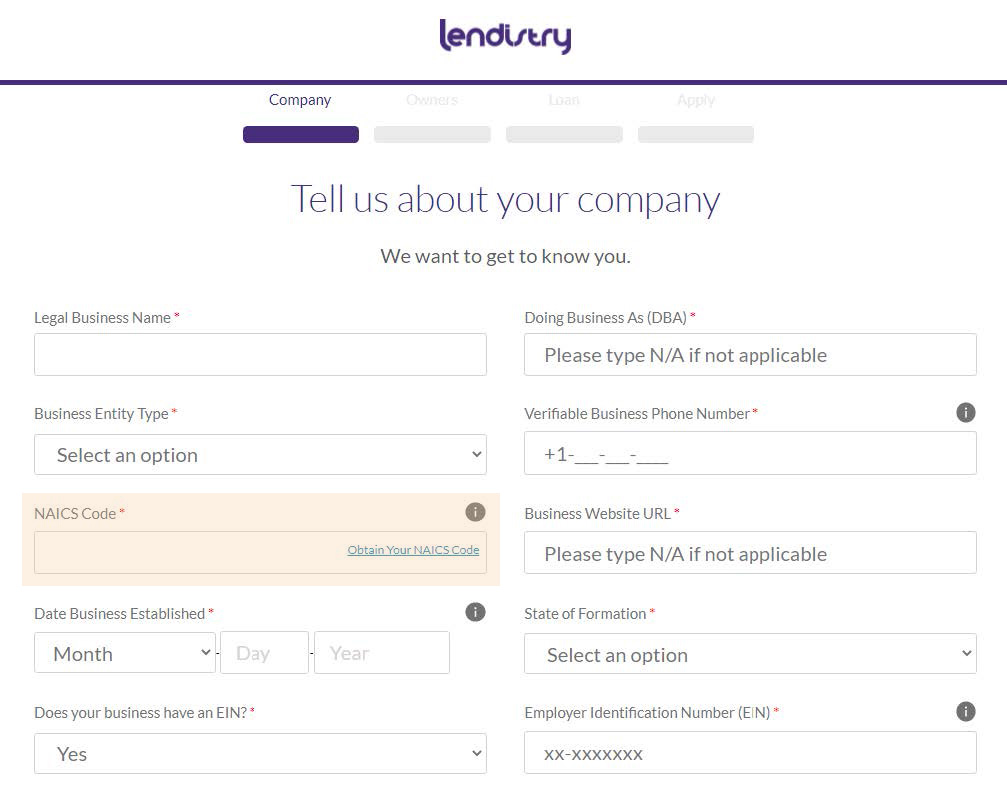

Company

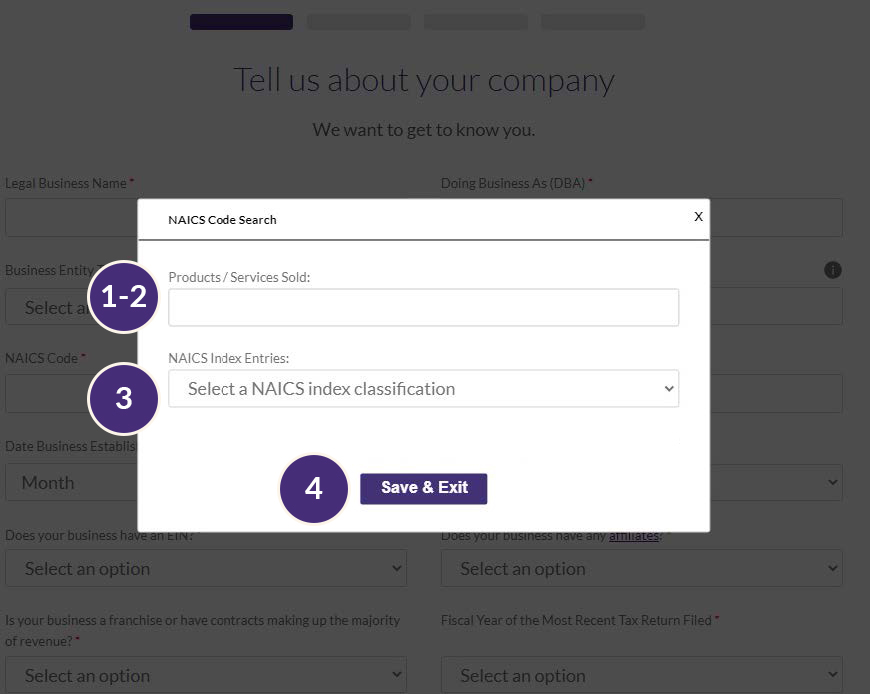

Obtain Your NAICS Code - Search

What is your NAICS Code?

The North American Industry Classification System (NAICS) groups establishments into industries based on the similarity of their production processes. Your NAICS Code is self-assigned and based on your own assessment of the primary activity of your business. The comprehensive system covers all economic activities, with 20 sectors and more than 1,000 industries in 2022 NAICS United States.

Using the tool provided during the application process, start typing the primary Products/Services Sold by your business in that field and select the most appropriate one. Then select the correct NAICS Index classification. If you have questions on how to use the tool, click “Help.”

For more information about NAICS in general, visit the United States Census Bureau NAICS website.

Use Lendistry’s tool to obtain your NAICS Code by following these simple steps.

Step 1

Enter the industry keyword(s) that best describes the primary products/services sold by your business.

Step 2

Select the most appropriate NAICS & Title

Step 3

Select a NAICS Index Classification

Step 4

Save & Exit

Unable to find your NAICS Code?

If you do not find an appropriate NAICS Code using the keywords you entered, visit the U.S. Census Bureau for other NAICS Code Search options. Once you find your NAICS Code, exit the NAICS Code Search window and type in your 6-digit NAICS Code directly into the NAICS Code field.

What is a verifiable business phone number?

This phone number will be verified against the applicant business. If the business does not have a verifiable phone number, please list the phone number related to it.

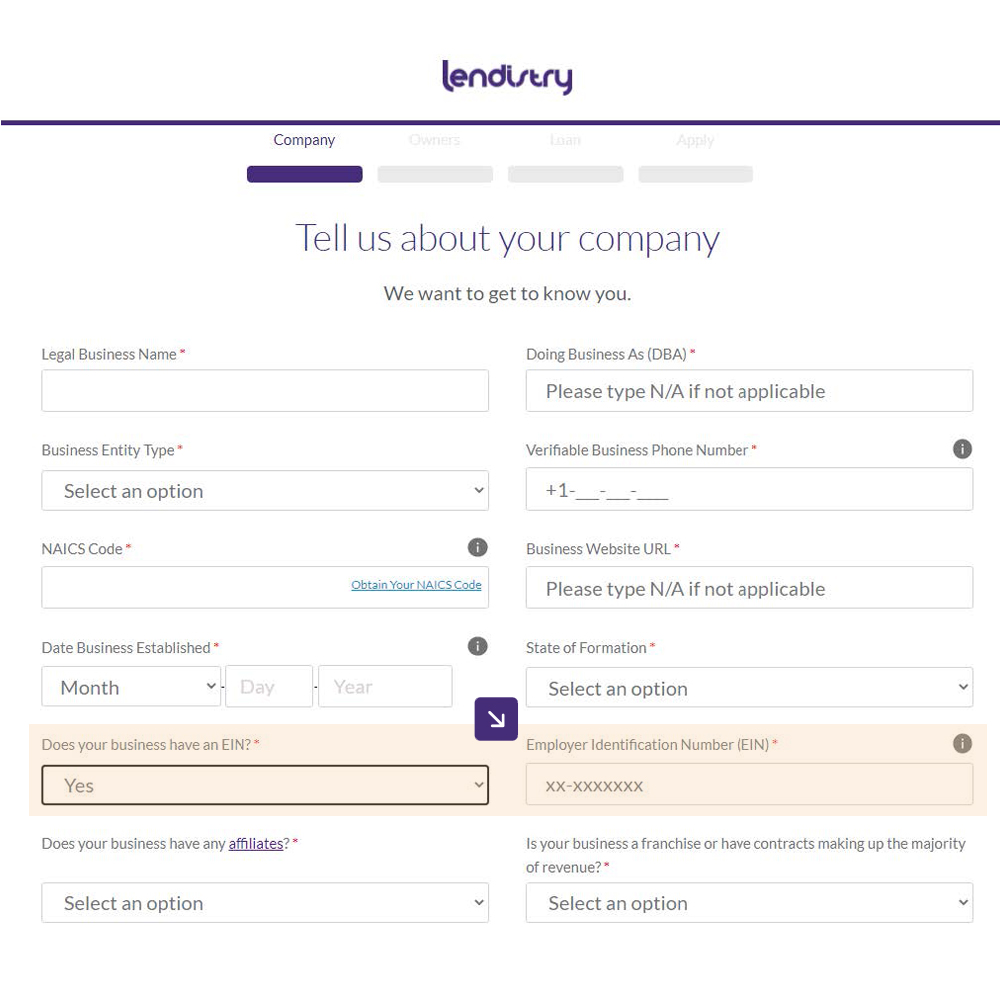

What is your Employer Identification Number (EIN)?

An Employer Identification Number (EIN) is also known as a Federal Tax Identification Number, and is used to identify a business entity.

If interested, you may obtain an EIN in various ways, including online. This is a free service offered by the Internal Revenue Service (IRS) and you can get your EIN immediately. Learn more at the IRS website.

Using your EIN

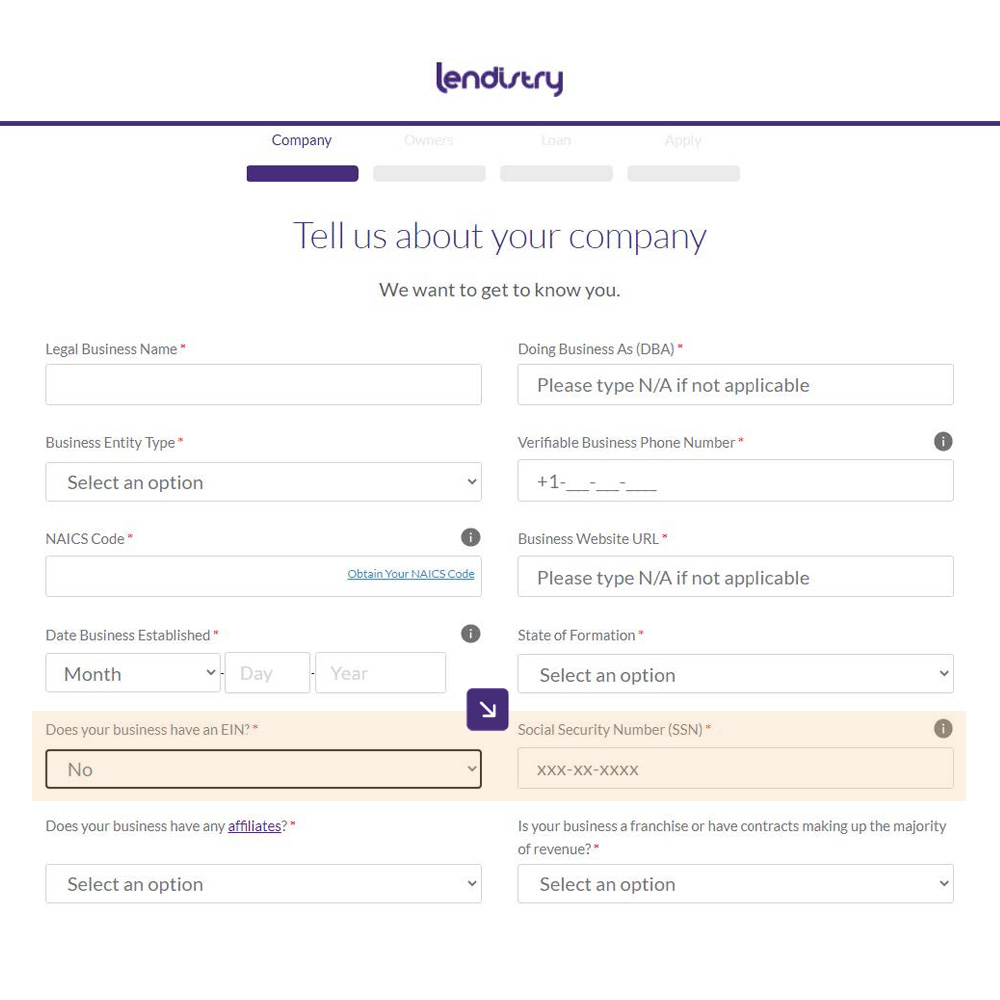

Generally, businesses need an EIN, but if you do not have one, you are able to provide your Social Security Number (SSN).

Does your business have any affiliates?

If you’re unsure, learn how the SBA determines affiliation from the Code of Federal Regulations.

Using your SSN

How to Determine Your Business’s:

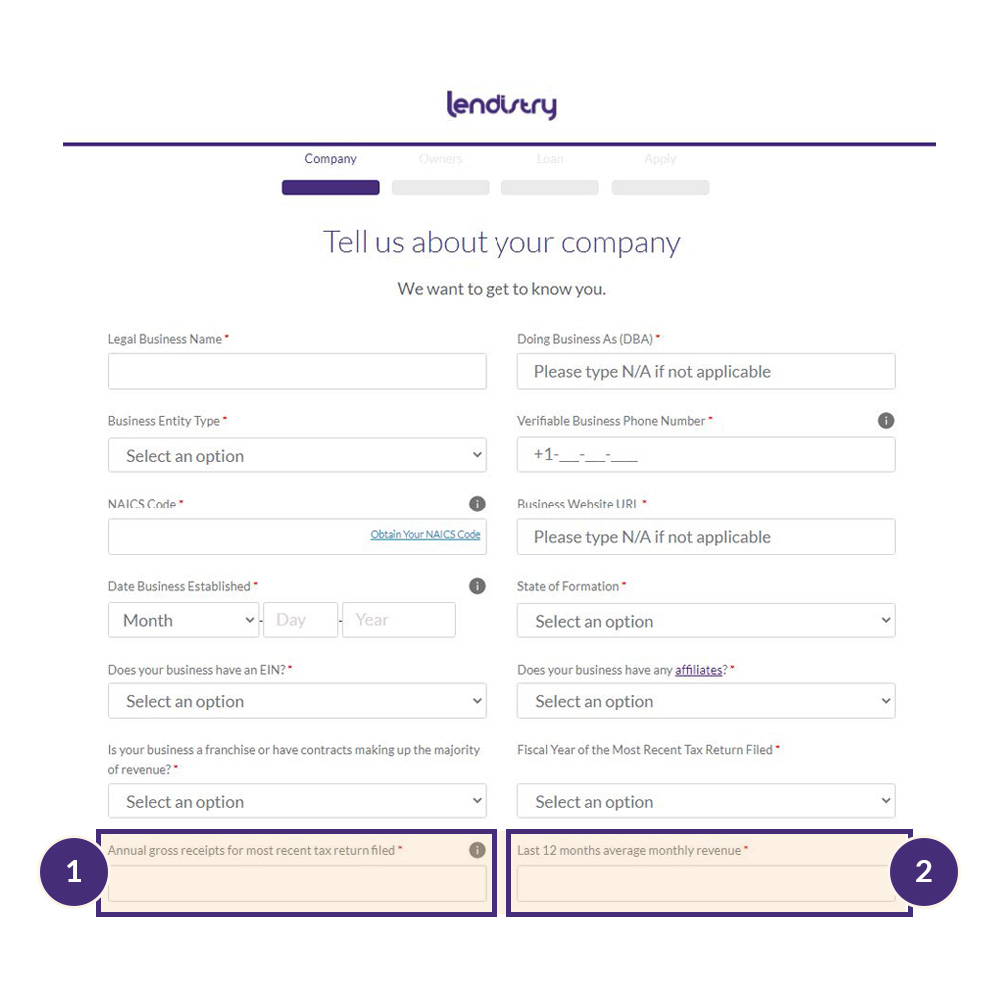

1. Annual Gross Receipts

This can be found on your most recently-filed Federal tax return. Depending on your business type, you can locate it on one of these lines:

- IRS Form 1120 or 1065, line 1a

- IRS Form 1040 Schedule C, line 1; or

- IRS Form 1040 Schedule F, sum of line 1a + line 2

2. Last 12 Months Average Monthly Revenue

To determine your current average monthly revenue, take your business’s estimated total revenue from the previous 12 months since applying and divide it by 12.

| Business’s estimated 12-month total revenue |

/ 12 = | Current Average Monthly Revenue |

Owners

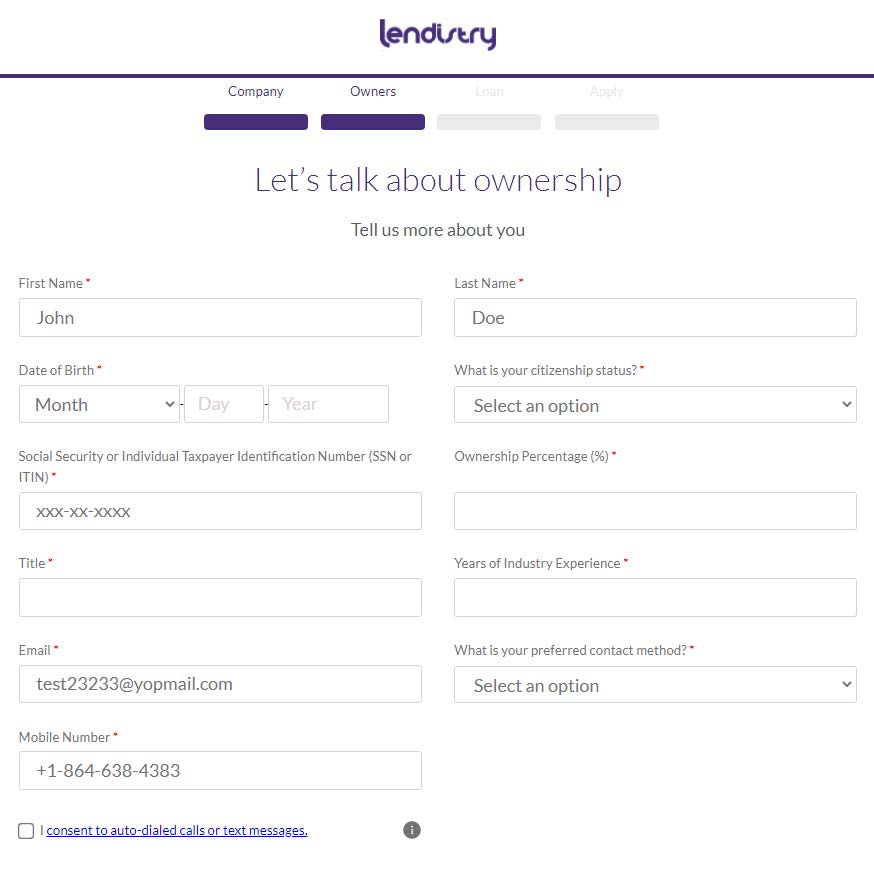

Providing Ownership Information

Add each owner with 20% or more of the equity of the business.

If no owner has at least 20% ownership of the business, you must list enough owners whose combined equity represents at least 51% of the ownership of the business.

Listed equity does not have to total to 100% at this time.

Certain loans will require identification and information of all owners for final approval.

If an owner is not from the United States, and therefore does not have a Social Security Number (SSN), the owner can enter their Individual Taxpayer Identification Number (ITIN).

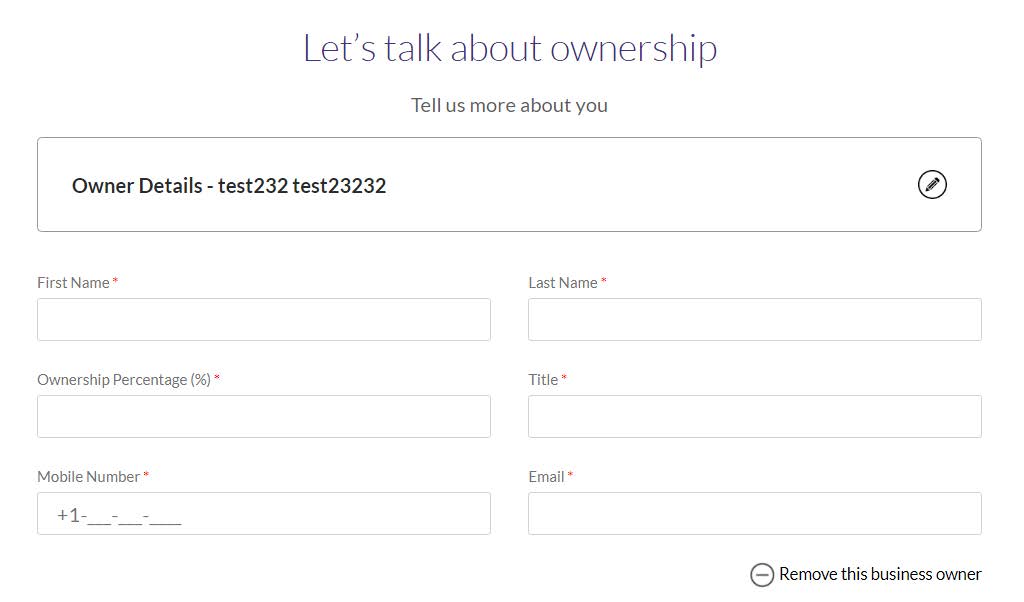

Adding Another Business Owner

When you provide an additional owner’s contact information after you submit the application, the additional owner will be sent an email to provide information about themselves to proceed with the application.

Your information will not be shared with them and whatever personal information they provide will not be shared with you.

Loan

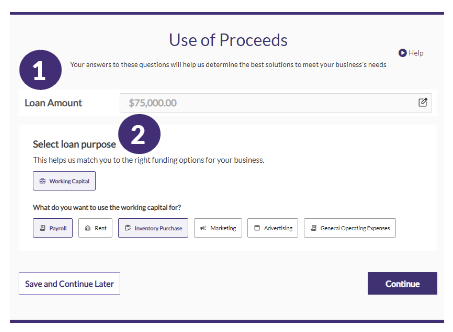

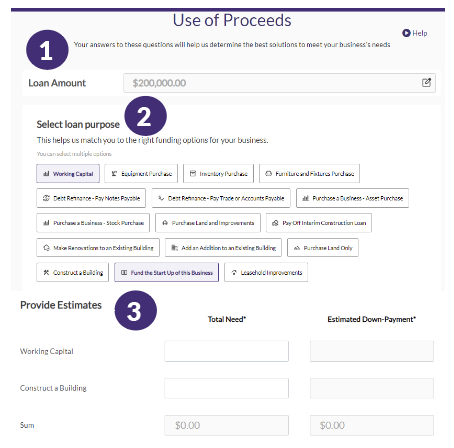

How much are you requesting and what will you use the financing for?

Your answer to these questions helps us determine the best solutions to meet your business needs.

Step 1

Confirm the loan amount you are requesting.

Step 2

Select the loan purpose(s)

- If you request less than or equal to $150,000 the loan purpose option will automatically be Working Capital and you need to select what you want to use the working capital for and skip to Step 4.

- If you request more than $150,000, select the loan purpose(s) for financing and proceed to Step 3.

Step 3

Enter the total need for each purpose. The estimated down-payment and sum needed will be calculated automatically. *

Step 4

Select where the down-payment will come from.

Step 5

Click Continue.

*Calculated based on the total need, anticipated percent down and average closing costs. All subject to change.

Requesting less than or equal to $150,000

Requesting more than $150,000

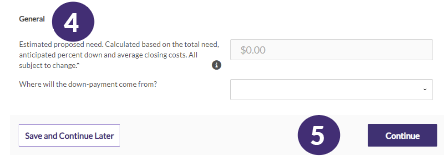

Review

Pre-Submission Application Review

Before submitting your application, you will be able to review your responses. You must complete all sections of the application in order to submit it.

This includes:

- Telling us about your company;

- Providing ownership information; and

- Explaining what you will use the financing for.

Reviewing Your Application

Step 1

If you need to edit your application, click on “I have some edits” and fix any errors.

Step 2

Read the Terms and Conditions and check the box to agree.

Step 3

Type your legal first and last name in the appropriate boxes, which represents your e-signature.

Step 4

Then click on “Submit” to submit your application. Once you submit your application, you will NOT be able to edit your responses.

Step 5

If you would like to review and submit your application at a later time, click on “Save and Come Back Later.” You can sign in to MyLendistry over the course of two weeks to review your application and make any edits if needed.

You will be able to log back in to MyLendistry at any time to check on status and updates.

Upload Documents

Required Documents

We need all pages of each required document

- Most recently filed three years of business tax returns.

- Most recently filed personal tax returns for the past year.

- All business license(s) required by law for your state/industry.

Uploading Your Documents

- Must be in clear, straight format with no disruptive backgrounds.

- File name CANNOT contain any special characters, such as !@#%^&*()_+=

- File size must be under 10MB

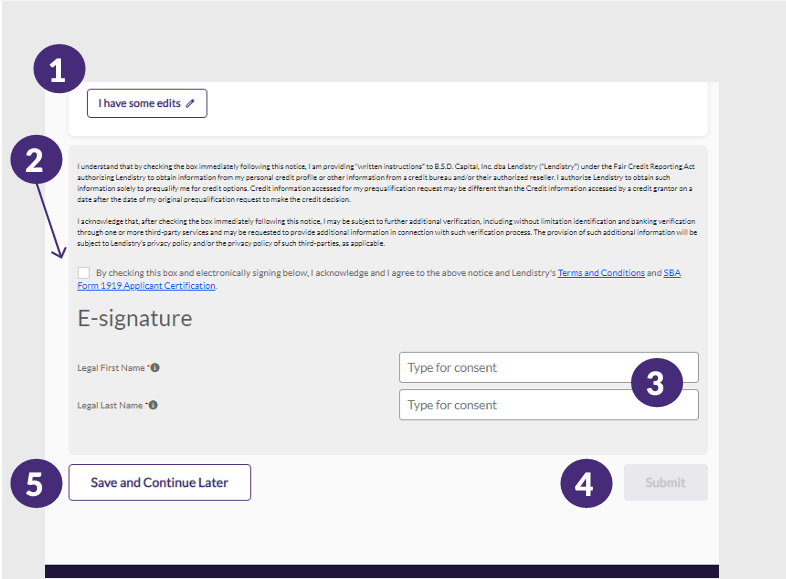

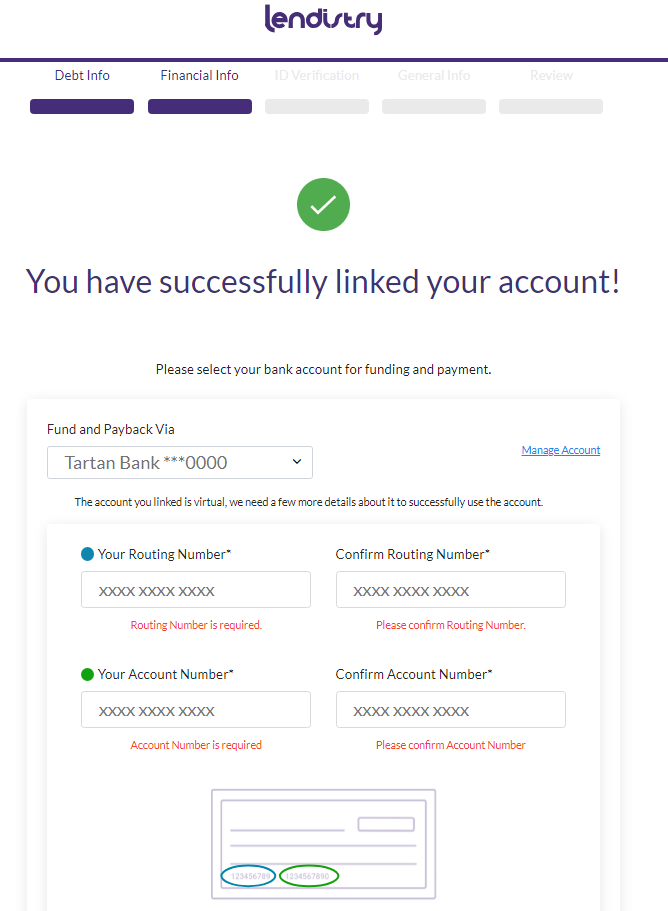

Financial Info (Plaid)

Using Plaid to Verify Your Bank Account in MyLendistry

What is Plaid?

Plaid is a quick, seamless way for you to provide what we need to verify your banking information. It replaces you having to scan and upload documents, making it easier for you and giving us an opportunity to provide you with a decision faster.

Plaid is a third-party technology Lendistry uses to set up Automated Clearing House (ACH) transfers by connecting accounts from any bank or credit union in the U.S. to MyLendistry. The third-party does not share your personal information without your permission and does not sell or rent it to outside companies. The use of personal information on or through Plaid is subject to Plaid’s End User Privacy Policy. Lendistry uses this technology to verify and review your bank statements.

This method of bank verification is preferred, but may not be acceptable if your banking institution is not available through the provider. In this case, you can verify your bank account using other methods.

Hear from a real Lendistry customer about this step of the process.

When registering in MyLendistry, you will be prompted to provide bank details. Click “Start Plaid”.

Step 1

Select your bank and provide credentials.

Step 2

After following directions in Plaid, you will be back in MyLendistry and if you have more than one account in the selected bank, they will all be listed. Select the account you would like to use.

Step 3

Provide the routing number and account number.

If you run into errors, you have the option to try again. If you continuously run into errors or your bank institution is not available through the provider, you can proceed using another method that will be provided.

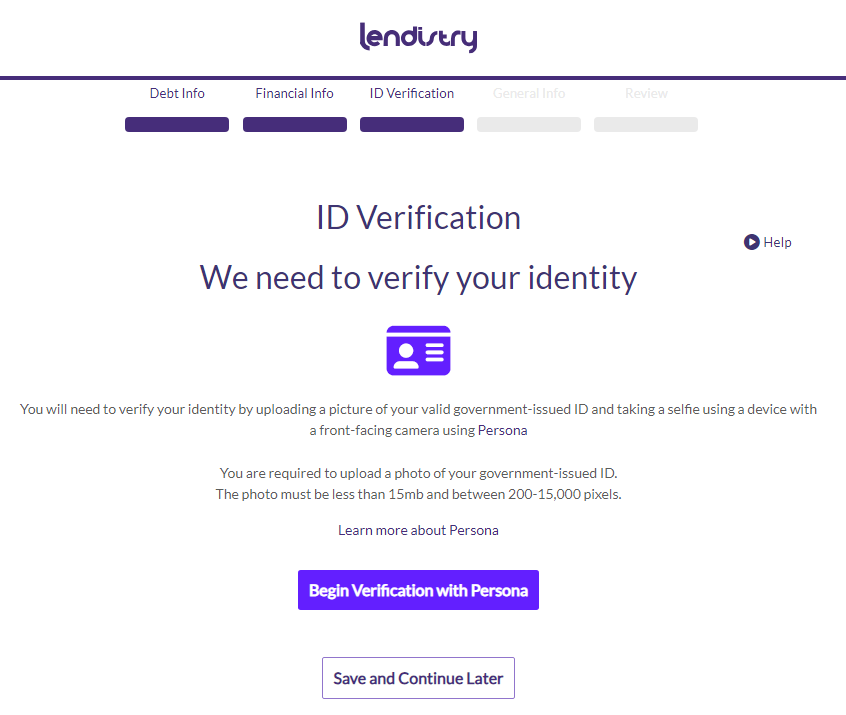

ID Verification (Persona)

Verifying Your Identity with Persona

How to Complete Persona

What is Persona?

Persona is a third-party platform utilized by Lendistry in its fraud prevention and mitigation process. It enables Lendistry to verify an individual’s identity and protect against identity spoofing by automatically comparing the individual’s selfie to their ID portrait with a 3-point composite and biometric liveness checks.

Hear from a real Lendistry customer about this step of the process.

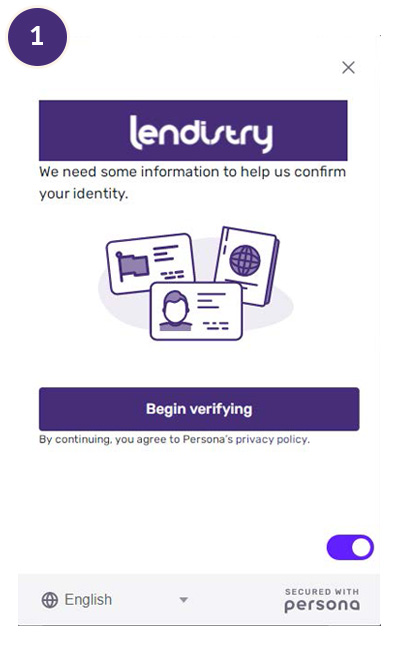

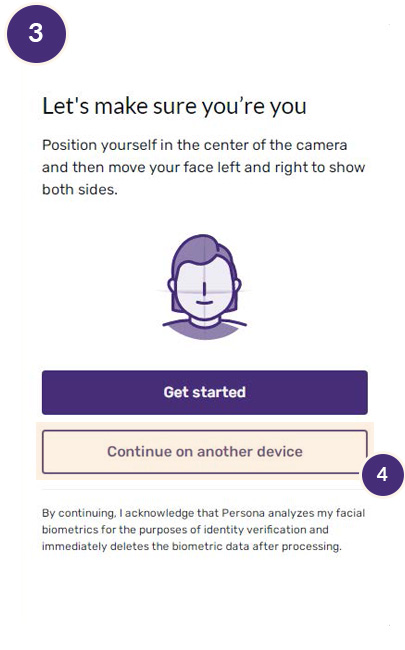

Step 1

Begin verifying your identity using Persona

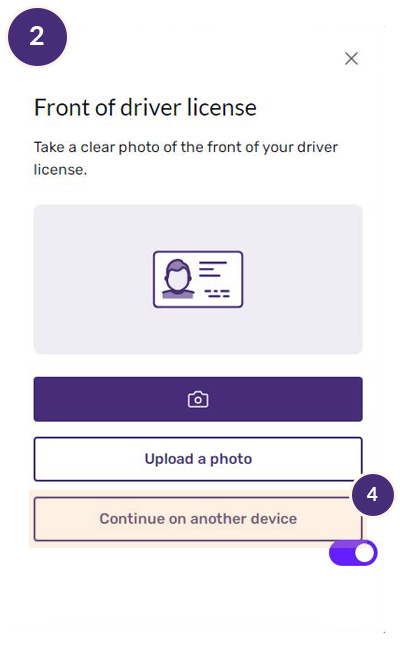

Step 2

Upload a picture of your valid government-issued ID (driver license, state ID, passport or passport card) that is less than 15mb and between 200-15,000 pixels

Step 3

Take a selfie using a device with a front-facing camera

4

Having trouble with Steps 2 & 3? (Optional)

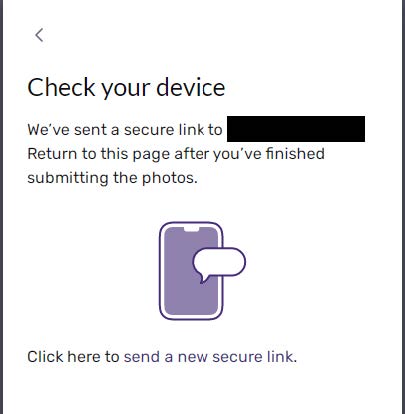

Select “Continue on another device”

- If applying on your computer, sometimes it is easier to take a picture of your government-issued ID and a selfie on another device, specifically your cell phone.

- To easily continue this aspect of the application on your cell phone, select “Continue on another device” and follow the simple, secure steps provided.

- After taking the pictures with your cell phone (or whatever other device you choose), return to the original device you were using to complete the application.

4

Optional

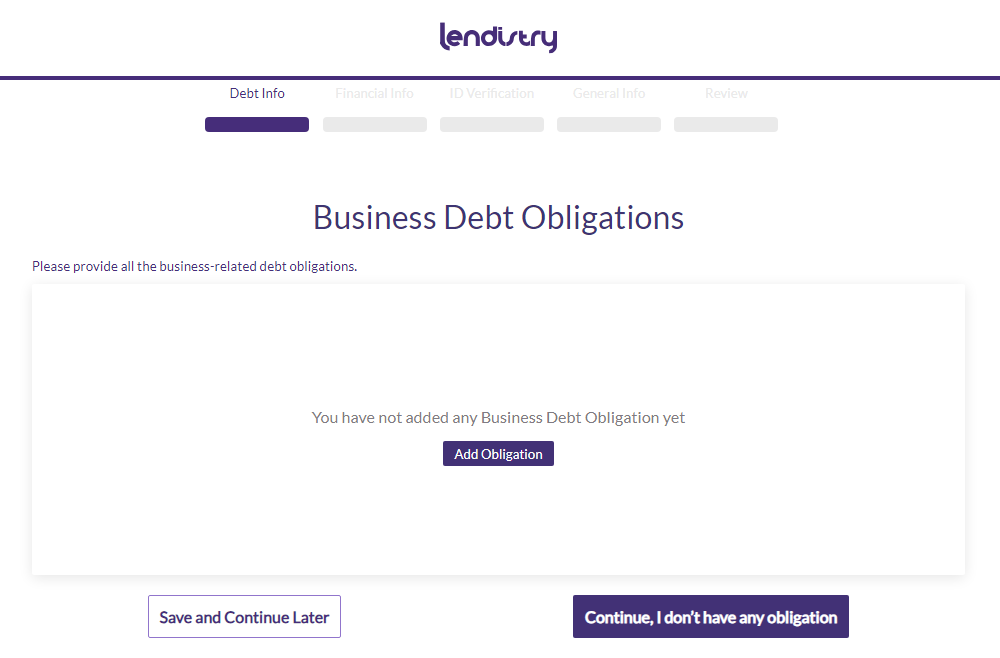

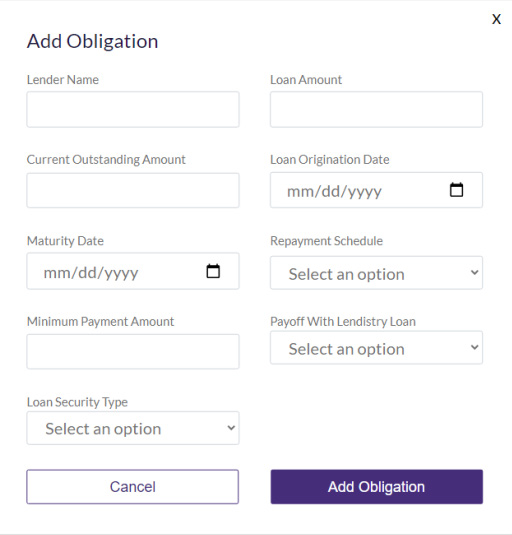

Business Debt Obligations

Providing Business Debt Obligations Information

Please add all business debt obligations you may have. If you don’t have any, please continue.

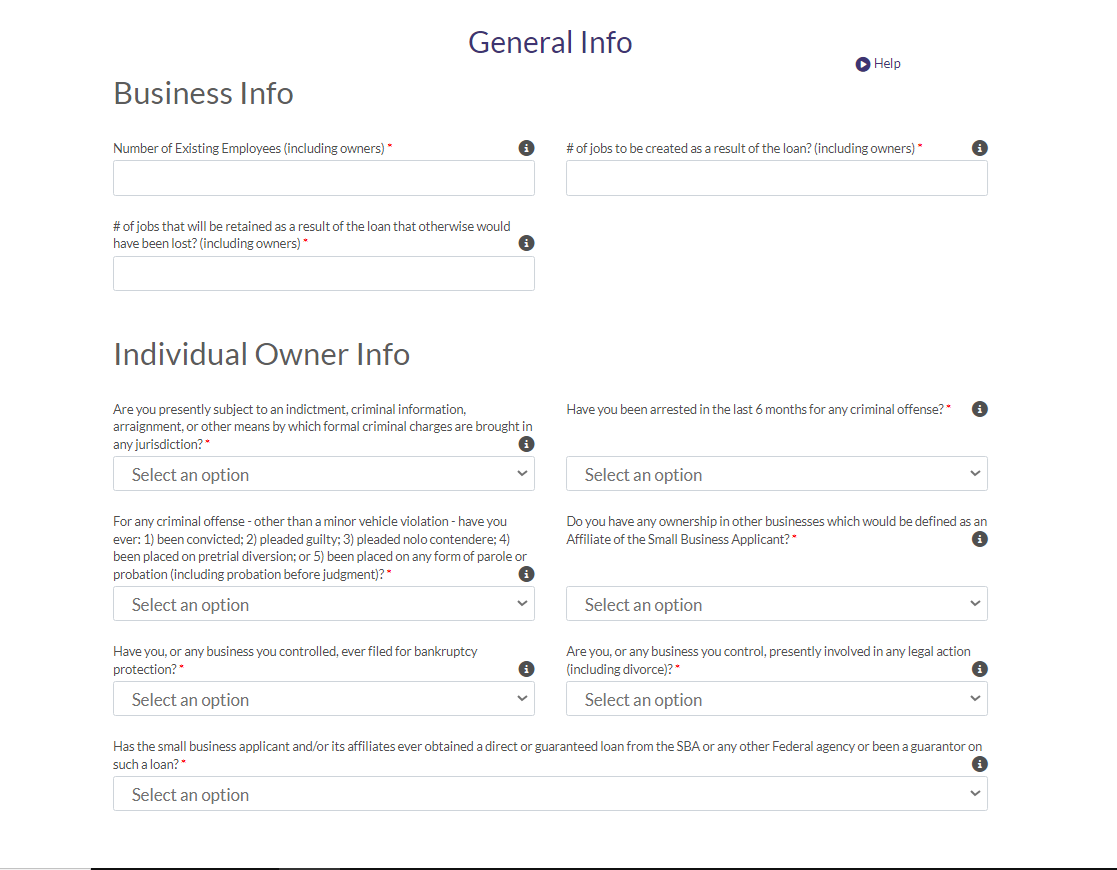

Additional General Information

General Information Needed

Please complete this section to the best of your knowledge. This information helps us determine the best solutions to meet your business needs.

Need More Help?

Who can I contact with questions about the application process?

You can contact the Lendistry Customer Experience Center:

855-476-5870

Monday – Friday

7:00 am to 7:00 pm PT

Closed on all Federal holidays. Lendistry is also closed the day after Thanksgiving and the day after Christmas.

Para obtener servicios en otro idioma que no sea inglés, póngase en contacto con nuestro Centro de Experiencia al Cliente. Llame al (855) 476-5870 de lunes a viernes de 7:00 am a 7:00 pm (PT).

Additional Resources

When Applying for a Loan, What Affects Your Credit & What Doesn’t?

Your credit history and three-digit personal credit score are important parts of your small business’s profile. They affect whether or not you qualify for a small business loan, SBA loan, commercial real estate loan, or other credit product. They also affect what...