Your credit score is a crucial component in applying for small business funding. Lenders use your score to assess your responsibility as a borrower and, as a result, whether they should lend to your business.

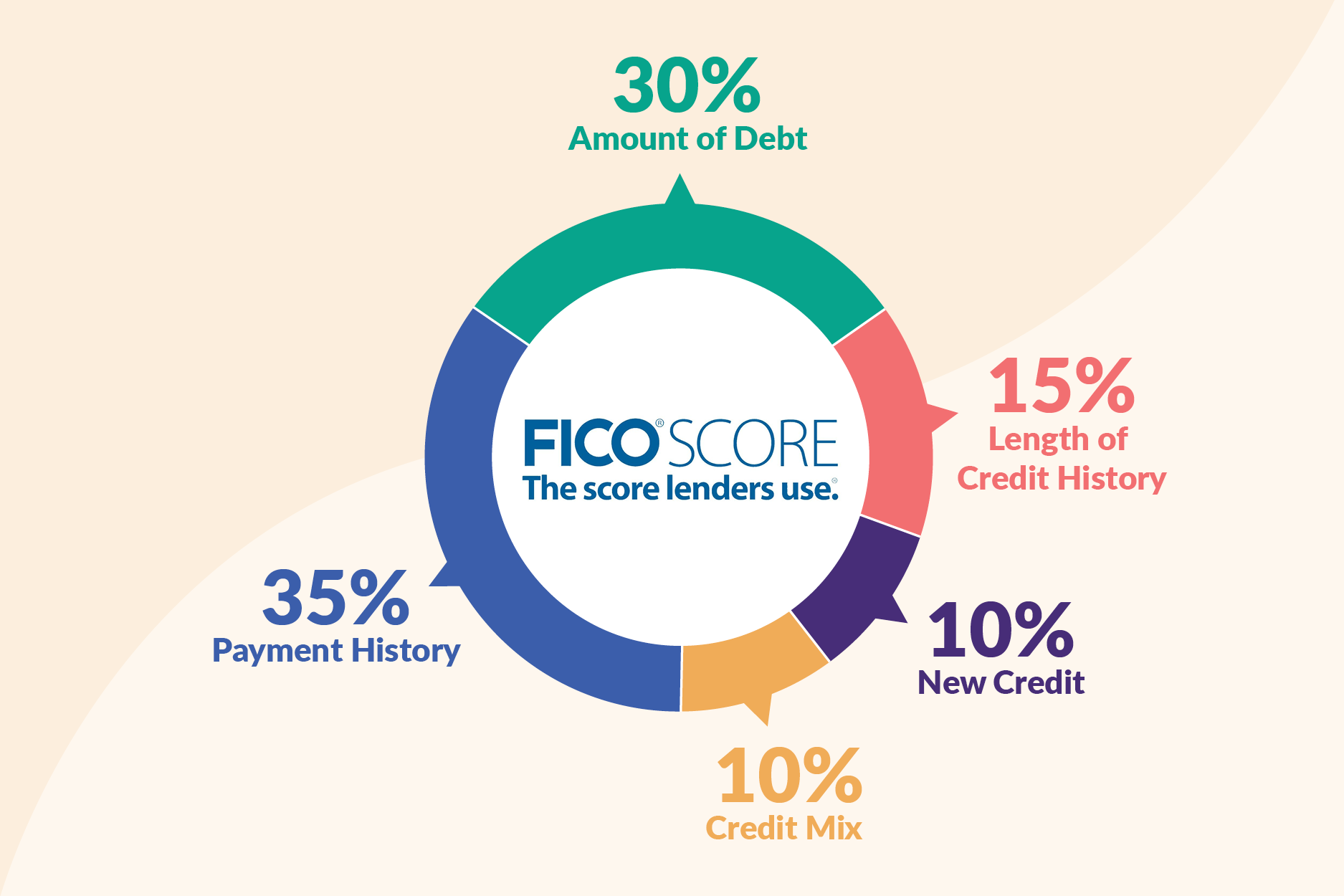

Maintaining a good credit score is key for setting your small business up for a successful application, but it can be tricky if you don’t know what affects your score. If you’re working on building your credit score, remember the following five elements that FICO considers.

Payment History: 35% of Your FICO Score

This is your track record for making payments on accounts such as credit cards, retail accounts, installment loans, finance company accounts, and mortgage loans in the past. This factor looks at whether you made payments on time or late, or if you missed any payments entirely. It also considers any public record and collection items such as bankruptcies, foreclosures, suits, and wage attachments. This factor’s impact on your score varies depending on how late, severe, and recent the late payment was.

Amount of Debt: 30% Your FICO Score

This factor looks at how much credit you’re using and how much you owe. It considers:

- The total debt you owe across all accounts

- The amount you owe on specific accounts like revolving credit or installment loans

- How many accounts on which you have a debt balance. If you have too many accounts with a balance, lenders may think you have too much debt to manage.

- Your credit utilization ratio on revolving accounts. This is the amount of credit you’re using compared to the amount that you have available to use. If you’re close to running out of credit on your accounts, this could indicate that you may have trouble making future payments.

- The remaining balance owed on installment loans. Paying these loans on time shows lenders that you’re a responsible borrower who can effectively manage debt.

Length of Credit History: 15% of Your FICO Score

This factor tracks how long you’ve had credit, starting with your oldest account. It looks at the age of your oldest account, the average age of your accounts, and the age of specific account types like credit cards or auto loans. The more credit history you have, the more you’ve established yourself as a trustworthy borrower, as long as you’ve been on top of your payments consistently.

New Credit: 10% of Your FICO Score

This factor considers any accounts you’ve opened within the last 12 months. It includes how many new accounts you have, what they were for, how long it’s been since you opened a new account, and how many requests for credit you’ve made. Most FICO High Achievers haven’t opened a new account for an average of two years and five months.

This factor also takes rate shopping into account. If you have multiple credit inquiries for a type of loan that may involve rate shopping, such as a mortgage, car loan, or student loans, FICO recognizes this as rate shopping. All inquiries made within a certain shopping period — 14 days for older FICO versions and 45 days for newer versions — are viewed as one inquiry so that you’re not penalized for looking for the best terms.

Credit Mix: 10% of Your FICO Score

This factor looks at the different types of credit accounts you have, such as credit cards, retail accounts, installment loans, and mortgage loans. The importance of this factor varies based on how much other information is available in your credit report. It will have a greater impact on your score if there is less information in your report.

Keep in mind that every lender has its own standards for the credit scores they expect from small business borrowers. The average FICO score is 695, and many lenders will provide loans to borrowers with scores within the “Fair” range. As you work to build your credit score, remember that the best way to do so is not to fear debt, but to be strategic with it.