Lendistry was started because our team of founders spent their careers witnessing the barriers that make it too hard for most small business owners to get the loans they need to purchase inventory, open a new location, or bring in some extra cash to support their day-to-day operations.

Read what some of our customers have to say

Lendistry was founded in 2015 to open doors and give small business owners a fair chance at getting the funds they need without resorting to predatory lenders.

At Lendistry, this is what capital to access looks like.

Choices

Responsible terms in low, medium and high amounts, because your capital needs don’t end after the first loan

Fintech

An online application that’s easy to complete anytime, anywhere, because coming to a branch isn’t an option for every business owner

Equitability

A different approach to making lending decisions, because every business is different, and they all deserve a fair chance to grow

Official Small Business Lender of LA Sparks

Official Small Business Lender of Gotham FC

Access to capital means access to options. Access to opportunity.

We are driven to help business owners and communities succeed.

$10.5 billion

Small business loans and grants

640,000

Small businesses supported

Hear what more customers have to say about Lendistry

Follow us on Instagram to see more of life at Lendistry.

Meet Lindsay Williams, founder of South LA Wine Club. She aims to create community through tastings while making wine approachable.

Way to go! @BBBBYBD

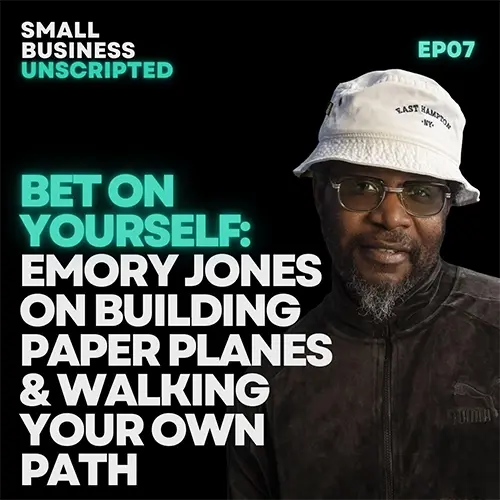

@vegas_jones of @planes sits down with our very own @everettksands to talk how building a brand has to match how you actually live.

We are proud to have attended the launch of the program in Atlanta, where small business owners learned firsthand how to create prosperous communities through the growth of their businesses. #smallbusiness @visa

See what we’re up to on LinkedIn.

The Center by Lendistry is a nonprofit strategic partner to Lendistry that supports small businesses through education, technical assistance, and access to competitive financing. Find out more.